Understanding Communications in European Residential Markets

Understanding Communications in European Residential Markets

Residential markets across Europe are facing combined pressures and challenges. Cyclical macro-economic headwinds have coalesced with an evolution in how consumers interact with the built environment post-pandemic; and what they expect of it.

European residential markets are in transition; many are experiencing the same structural, demographic and economic challenges (supply and demand, aging populations and affordability and inflation), yet different countries in Europe exhibit a diversity of perceptions of their domestic housing markets.

As a developer, asset manager or investor, understanding these dynamics is critical in developing robust communications campaigns – be that understanding perceptions around asset type, how different demographics consume content and the variations that exist across geographies.

In response, ING has explored key data to investigate some core assumptions about selected European residential markets. As the communications landscape continually shifts, refreshing strategies to understand market penetration and consumer experience will help develop a competitive position in target markets.

As alternative living products emerge across geographies, having a clear understanding of asset type maturity and consumer perception is crucial.

Data plays a key role in focusing marketing on channels where it will be most effective, and a clear and current understanding of what target audiences really care about can help shape the most engaging content.

The built environment and public are not always aligned.

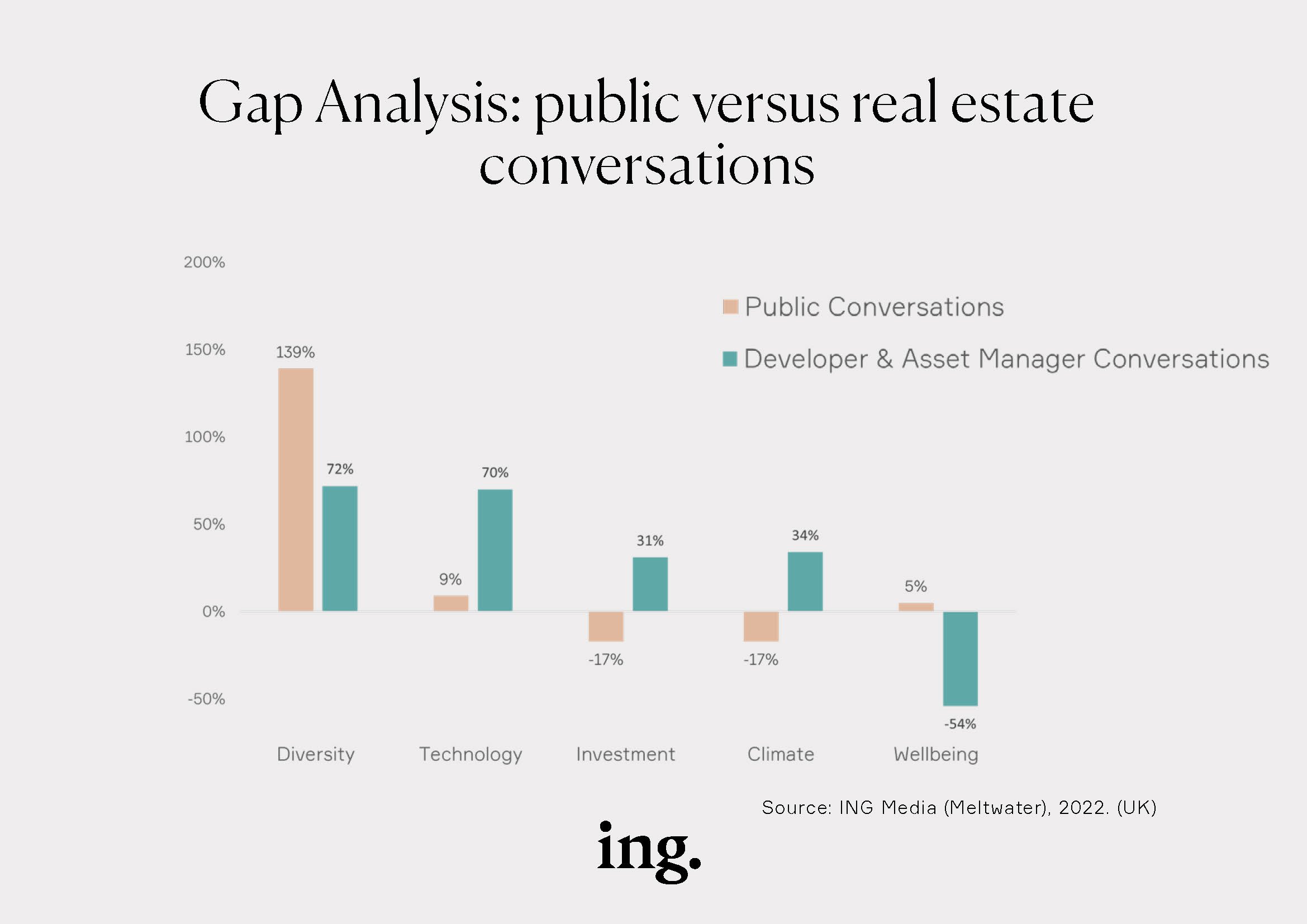

Understanding how European residents consume news and make their purchase decisions is crucial. Yet a gap persists with regard to what the built environment is talking about when compared to the public. This snapshot, taken from ING Media’s most recent ‘Gap Analysis’, validates our belief that the property sector and the public are not always aligned in terms of digital output.

Our analysis showed that the public is talking more about diversity and wellbeing (+139% and +5% year on year), yet the property sector talking more about tech and investment, business and climate (+70%, +31% and +34%). We are currently engaged in the process of updating this analysis; however, the foundation of work conducted in 2021 continues to uphold its integrity.

When communicating key themes around the benefits and selling points of an asset, target audiences need to be considered. What are people really talking about when it comes to housing? For example, are benefits and amenities listed in new schemes really what consumers want?

Conversations around living vary across compass points of Europe.

For the purpose of this investigation, we created a European Compass to measure a selection of countries, selected by geography and maturity of certain markets. Northern Europe includes Denmark, Finland and Sweden; Eastern Europe, Poland, Czechia and Slovenia, Southern Europe includes Italy, Portugal and Spain and Western Europe, Germany, France and the UK.

This chart analyses total share of conversations across 2022. We define conversations as digital mentions across online media, including Twitter, forums, blogs, Reddit, Facebook, Instagram, Instagram, YouTube, TikTok, Twitch, comments and reviews. Within this we have measured the percentage share of conversations around each asset class. Analysing that breakdown shows some patterns emerging; the majority of public conversations in Western Europe are based on senior living – perhaps not surprising given the demand for care homes and ageing populations exhibited in those three countries.

In Eastern Europe conversations around Build to Rent make up a significant proportion of conversations last year, indicating supply and demand issues in a region where a significant majority of the population are homeowners. Co-living came out as the most talked about alternative in Northern Europe, an asset class which has been adopted earlier than other regions in Europe.

What does this tell us? Firstly, conversations around different sorts of living vary across the continent, reflective of the different maturity levels of those modes of living. Understanding this across a European portfolio of real estate is a must for an effective communications effort.

Not only are the conversations around assets different, but so are the themes.

Conversations across our European Compass also differ by theme. We have broken down total conversation share and attributed keywords to the themes of Social / Diversity, Technology, Investment, Climate, Wellbeing and Amenities.

The results show compelling evidence that within the residential conversational landscape, mentions around Technology are high in Southern Europe. This does not mean that Tech is more established in the Southern European market, but that conversations around that subject are higher. Tech conversations are lower in Western Europe because tech enabled buildings are a given in the development phase. London was recently rated as “Europe’s No 1 Smart City” in a study by ProptechOS, edging out Amsterdam in second place and Berlin in third with Paris and Lisbon coming in fourth and fifth respectively.

Wellbeing mentions make up a greater proportion of the conversations within Northern and Western Europe – showing that it has become a priority component within the residential conversation. These useful metrics show at any given time what components of these markets are most important to the consumers, fully informing marketing and communications campaigns for particular geographical audiences.

European countries talking the most about residential assets…

We have ranked each of the twelve countries included in our European Compass by volume of conversations around each asset class. The UK leads on conversations around Built to Rent, Senior Living and Age qualified living, France on Student living and Germany on Co-living. These countries are generating significantly more mentions on digital media relative to the other countries selected in our analysis. Stakeholders invested within each sub-sector should consider both if these markets are currently over subscribed and if alternate markets are primed to explore.

Ranking number of conversations of living assets by mentions in European Compass countries.

And which cities are talking about residential assets…

Allied to this we have investigated those asset classes by top mentions by city. The patterns follow the country wide data with London leading on conversations around Built to Rent, Senior Living and Age qualified living, Paris on Student living and Hamburg, not Berlin or Munich on Co-living. Paying attention to which cities are generating most digital content around each alternate living class can inform stakeholders similarly to the country wide data, which markets are potentially saturated, and which may be primed for exploration.

Ranking number of conversations of living assets by mentions in European Compass cities.

Asset maturity and consumer perceptions differ from country-to-country. Although trends around how different demographics consume news and make purchasing decisions exist, there is no one-size-fits all approach for those assets, country to country. There are generational differences in how people consume content across those geographies too. As alternative nascent residential markets mature at different speeds, a concerted communications strategy is required to ensure penetration of desired customers. Interweaving consumer and conversations trends into the scoping, planning and development stage of any residential asset can be invaluable.

Taking all this into account we can draw some conclusions on how communications experts should consider messaging and positioning across these varied markets.

The marketing and communications landscape is continually shifting, and digitisation is accelerating that change. Communications and marketing strategies need continual review to ensure they keep pace.

In parallel, alternative living concepts are evolving, with different concepts at different stages of maturity, and there are clear regional differences in conversations about what audiences consider and how they consume media.

Data can play a key role focusing marketing on those channels where it will be most effective, and a clear and current understanding of what target audiences really care about can help shape the most engaging content.

PREVIOUS REPORTS