The UK’s Most Talked About Cities 2023

The UK’s Most Talked About Cities 2023

“Where visibility leads, investment and prosperity follow.”

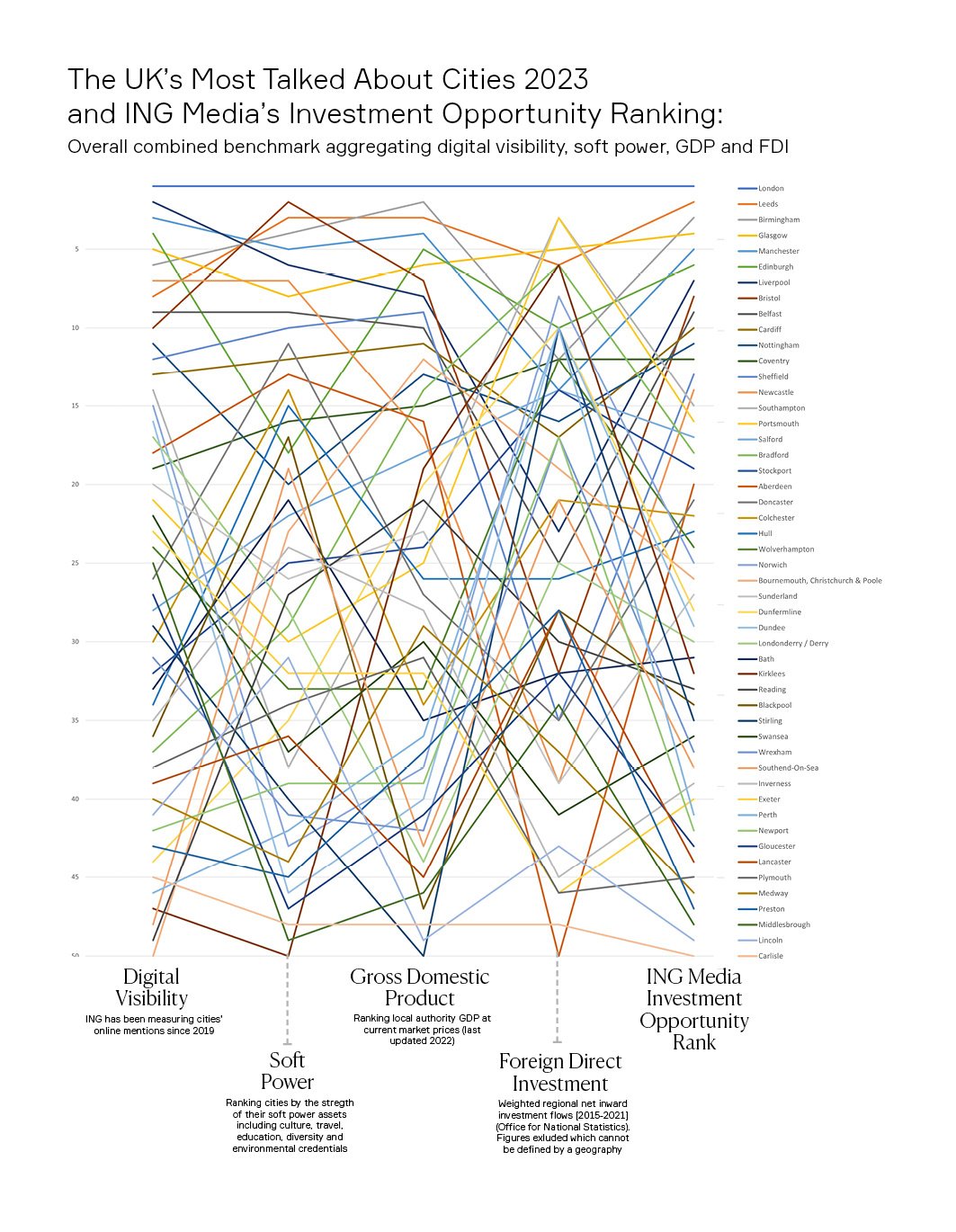

ING Media’s analysis shows that a series of direct positive correlations exist between digital visibility and soft power, gross domestic product and regional foreign direct investment. Allied to this we have aggregated these metrics into a unified benchmark - our overall Investment Opportunity Rank. This is a succinct measurement to rank cities by how digital performance affects economic output.

Our UK cities Investment Opportunity Rank is not determined by one single element – but increasing digital output can lead to improved performance across other pillars.

An elevated soft power profile can improve both GDP and FDI. Increasing awareness around cultural assets leads to improved resident, tourist and business spend, enabling a city to grow and prosper.

International and domestic investors seek to deploy capital into cities and their cultural assets, to exercise their own soft power and ESG compliance. Communicating soft power increases a city’s “pull”, which helps to develop long-term value to investors.

Future investment opportunity prospects are dependent on a variety of social and economic indicators, yet scoring highly in digital visibility and soft power, directly influences future investor intent.

ING UK Cities Digital Visibility Series 2023

ING Media’s research into the UK’s most talked about cities provides vital insight into the impact of digital messaging on cities as brands – and how this affects economic growth, future prosperity and investable destinations

A shift in attitudes and priorities from residents, tourists and businesses since the pandemic has affected how stakeholders interact with the built-environment, and what they expect from it. The UK’s cities are at the vanguard of prosperity, innovation and investment; communicating narratives and activating consumer and business spend is crucial as economic turbulence affects confidence.

For this research ING has taken a selection of 50 cities, based on the UK’s three most important city networks; Key Cities, Core Cities and the Scottish Cities Alliance, and has ranked them according to their share of online conversations.

While the overall number of digital mentions of these cities has decreased 5% year-on-year, with output levelling out following post Covid-19-related increases in 2021, the overall digital visibility ranking positions of many cities has changed.

In 2023, for both Europe’s and the UK’s Most Talked About Cities reports, we have extended the research beyond digital visibility metrics. We have incorporated several new rankings to fully understand the benefits of elevating a city’s brand through communications.

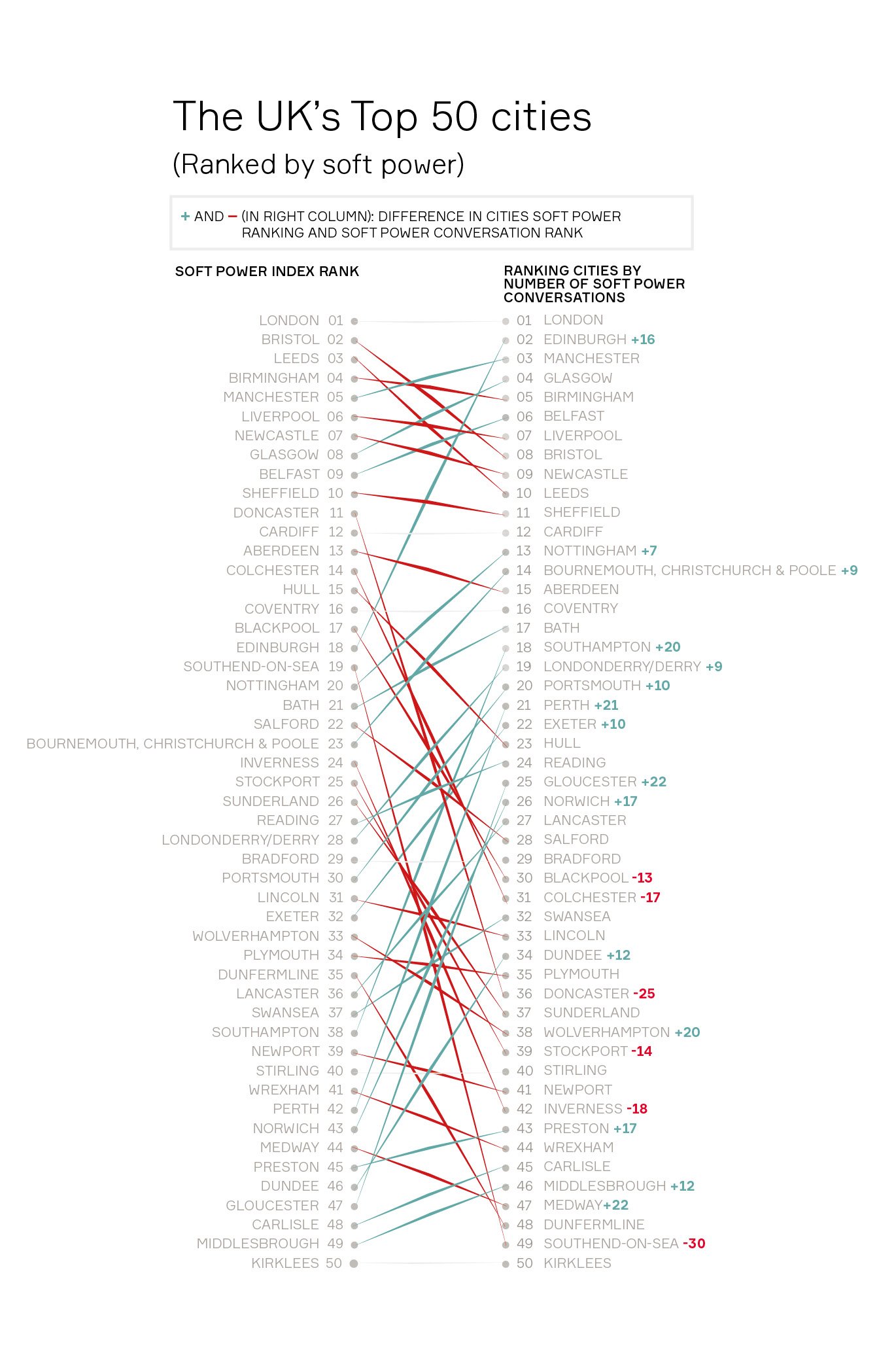

In response, ING has created a soft power index, a unique set of indicators designed to measure how the UK’s cities compare, assessing the influence of culture, travel, education, diversity, and environmental credentials on a city’s growth ambitions.

Allied to this, for the first time, our report incorporates economic indicators, ranking each city by its Gross Domestic Product (GDP) output and regional Foreign Direct Investment (FDI) flows.

The research indicates that several correlations exist between a city’s digital visibility, its soft power, GDP and FDI. We have aggregated this data series into one simple benchmark, ING’s “Investment Opportunity Rank” – which shows that the greater a city’s digital output is, the higher it sits on this ranking.

“We have extended the research beyond digital visibility metrics. We have incorporated several new rankings to fully understand the benefits of elevating a city’s brand through communications.”

THE UK’s MOST TALKED ABOUT CITIES (2023)

London (1st) continues to be the UK’s most talked about city, followed by Liverpool (2nd), Manchester (3rd), Edinburgh (4th) and Glasgow (5th).

A city’s digital visibility, its soft power, GDP and FDI are positively related.

Dundee jumps 9 places in visibility rankings due to increased coverage of local sport, increasing digital output by 163%.

Colchester’s new city status is already helping to amplify its soft power assets.

Norwich ranks 43rd on our soft power index but 15th on digital visibility. It is a good example of how sport as soft power, can increase a city’s visibility.

Salford Quays and MediaCityUK are becoming an international hub of high-tech creativity, driving prosperity in Salford and Manchester.

Newcastle’s objective of becoming a Science City, and its nightlife which contributes £340m annually to its economy, will continue to drive GDP.

Exeter has the largest number of meteorologists and climate change specialists in the UK. Additionally, investment into infrastructure is supporting the continued success of Exeter University.

Derry / Londonderry’s infrastructure offers affordable support to entrepreneurs, with a focus on life sciences growth.

Derry / Londonderry (+23), Swansea (+20) and Stockport (+13) are top rank-climbing cities with high digital visibility.

Sport remains the most common mention among our selected cities (28%). Sport has the power to affect politics, news and business conversations too.

Most cities mention themselves the most, but Bath, Plymouth, Blackpool, Lancaster, and Reading receive most of their mentions from London.

Capital cities have the highest mentions within each country, with Edinburgh finally beating Glasgow to become the most visible city in Scotland.

Mentions around culture are growing year on year. Culture made up 18% of the peak daily mentions in 2022, experiencing exponential growth from just 3% in 2020.

We will release more research on digital visibility throughout 2023.

ING Media’s investigation into The UK’s Most Talked About Cities (2023) covered 50 cities, based on the UK’s three most important city networks; Key Cities, Core Cities and the Scottish Cities Alliance, and ranked them by 2022 digital mentions. These mentions originate from Twitter, forums, blogs, Reddit, Facebook, Instagram, Instagram, YouTube, TikTok, Twitch, comments and reviews. Spelling variants included to cover the following languages; English, Chinese (simplified), Spanish, Arabic, Portuguese, Japanese, Russian, German, French, Malaysian, Indonesian, as well as the city’s native language. Mentions containing sports, in particular football, have been limited. Key topic shares, generated from a set of keywords unique to each category, represent only English mentions.

ING Media’s Soft Power rankings categorizes our selected 50 cities by several quantifiable social and cultural metrics that impact a city’s potential exposure on a global stage. These metrics include Number of stadia [25,000 capacity and above], number of museums and galleries across all faculties, number of Universities, number of hotel rooms, non-native born population, number of airports that serve city, UNESCO world heritage sites, number of Michelin Star restaurants, UK Competitiveness index 2021, annual population change and a ING Media ‘Green Score’ defined by multiple criteria [City Net Zero Carbon Target [Year], Air Quality [PM2.5 ug/m3], and Green Area [GA, %].

ING also measured economic activity of the 50 cities by measuring and ranking local authority GDP at current market prices (last updated 2022) and weighted regional net inward investment flows [2015-2021]. Both data sets are sourced from the Office for National Statistics [ONS]. Figures excluded which cannot be defined by a geography.

If you would like to learn more about the report and how ING works with cities: info@ing-media.com

PREVIOUS REPORTS